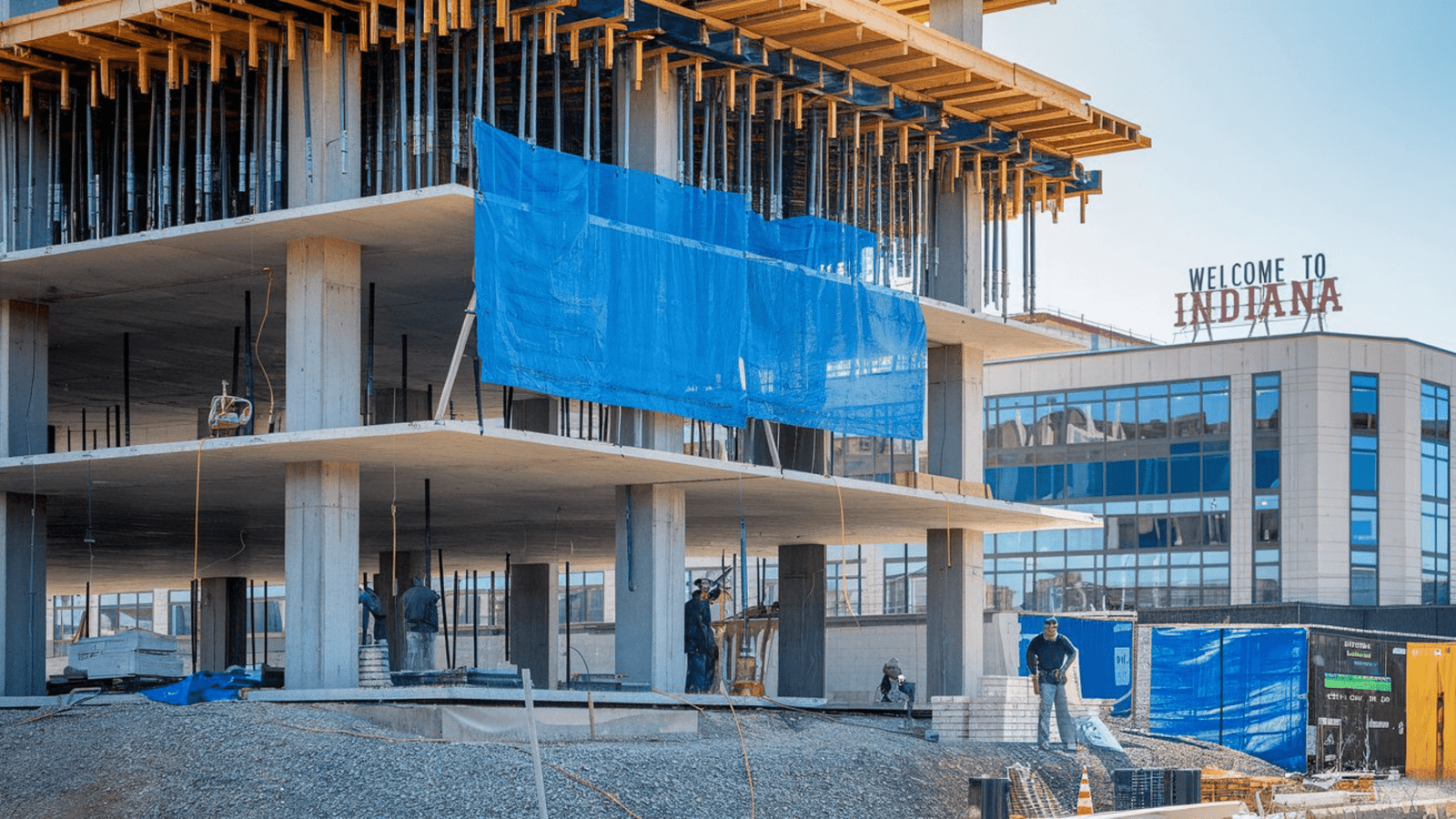

When taking on a construction project in Indiana, there are a few important considerations, and one of the most crucial is understanding Builders Risk Insurance. This specialized form of property insurance is designed to protect construction projects while they’re being built. But what does it cover? How does it benefit contractors and property owners? In this article, we will explain everything Indiana contractors need to know about Builders Risk Insurance.

What is Builders Risk Insurance?

Builders Risk Insurance is a temporary type of property insurance that covers a building under construction. It protects the project from various risks like fire, theft, vandalism, and certain weather-related damages. This insurance is specifically designed for structures under construction and helps to minimize financial risks for builders, contractors, and property owners.

If you are a contractor in Indiana, securing Builders Risk Insurance is vital. Construction projects are vulnerable to accidents and unforeseen events. Without proper insurance, a single incident could lead to significant financial losses. Builders Risk Insurance offers protection for both the materials used and the work completed, ensuring that the project can continue without costly interruptions.

Who Needs Builders Risk Insurance?

Anyone with a financial interest in a construction project may need Builders Risk Insurance. This typically includes:

- General contractors

- Property owners

- Subcontractors

- Lenders and investors

For Indiana contractors, this insurance is essential because it protects not only your materials but also your reputation. If your project is delayed due to damage, you could face significant penalties or lose future business opportunities. By having Builder’s Risk Insurance in place, you reduce the risk of these potential setbacks.

What Does Builders Risk Insurance Cover?

Builders Risk Insurance provides coverage for a wide range of risks and damages. Some of the most common things covered by this policy include:

- Fire: One of the most significant risks in any construction project. Builders Risk Insurance will cover the damages caused by a fire.

- Theft: Construction sites are often vulnerable to theft of materials or equipment. This insurance helps to recover the costs of stolen items.

- Vandalism: Any malicious damage done to the construction site will also be covered under Builder’s Risk Insurance.

- Weather Damage: This includes damage caused by severe storms, wind, lightning, or hail. It’s important to note that floods and earthquakes may require additional coverage.

This type of insurance typically does not cover normal wear and tear, faulty design, or employee theft. However, it can be customized based on the needs of your project.

Why is Builder’s Risk Insurance Important for Indiana Contractors?

Indiana is a state that experiences all types of weather conditions, from hot summers to freezing winters. Construction projects in Indiana are vulnerable to a wide range of potential damages. As a contractor, you want to protect your investment and keep your project on track. Builder’s Risk Insurance provides peace of mind by covering damages that could otherwise derail your progress.

Additionally, Indiana contractors often work on large projects with tight deadlines. Delays caused by accidents, theft, or vandalism could result in substantial penalties or financial losses. By having the right Builders Risk Insurance policy in place, you can mitigate these risks and focus on completing your project on time.

How Long Does Builders Risk Insurance Last?

Builders Risk Insurance is typically valid for the duration of the construction project. This can range from a few months to a couple of years, depending on the scope of the work. Once the project is completed and the building is ready for occupancy, the policy will end.

If the construction timeline extends beyond the original completion date, the policy can often be extended. It’s important to review the terms of your insurance policy carefully to ensure that you are covered for the entire duration of the project.

How Much Does Builder’s Risk Insurance Cost?

The cost of Builder’s Risk Insurance can vary depending on several factors, including:

- The size and scope of the project

- The location of the construction site

- The type of materials used

- The length of the project

On average, Builders Risk Insurance premiums range from 1% to 4% of the total construction budget. For larger projects, this may seem like a significant cost, but it is a necessary investment to protect against the risk of unforeseen damage or delays. Indiana contractors should factor this insurance into their project budgets early on to avoid surprises.

Choosing the Right Policy for Indiana Contractors

Selecting the right Builder’s Risk Insurance policy is crucial for Indiana contractors. You want to make sure that your coverage is comprehensive enough to protect against all potential risks but not so broad that you are paying for unnecessary coverage.

When choosing a policy, consider factors like the scope of your project, the materials being used, and the specific risks your construction site may face. Working with an insurance provider who understands the unique challenges of Indiana construction projects can help you find the best policy for your needs.

If you are looking for more information or need help selecting the right policy, check out Indiana Builders Risk Insurance to ensure your project is fully protected.

Conclusion

In conclusion, Builders Risk Insurance is a must-have for Indiana contractors. It provides essential protection against the many risks that can occur during a construction project, including fire, theft, vandalism, and weather damage. By investing in the right policy, contractors can safeguard their projects, minimize financial losses, and ensure that work continues without unnecessary delays.

If you are an Indiana contractor, now is the time to explore Builders Risk Insurance and secure the coverage that’s right for your next project.